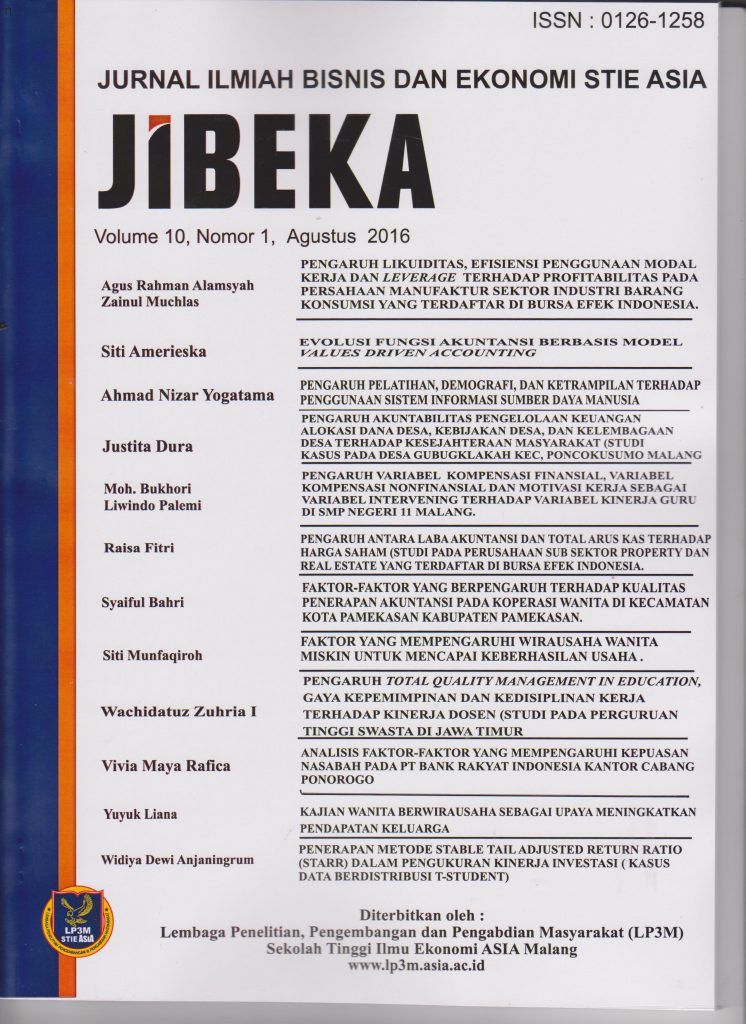

PENERAPAN METODE STABLE TAIL ADJUSTED RETURN RATIO (STARR) DALAM PENGUKURAN KINERJA INVESTASI

Kasus Data Berdistribusi T-Student

DOI:

https://doi.org/10.32812/jibeka.v10i2.78Keywords:

Investment Performance, STARR, VaR, CVaR, Sharpe Ratio, T-Student distributionArticle Metrics

Abstract

The purpose of this study was to determine the appropriate approach and method for measuring the performance of the investment, if the return data provided just a little or the data don’t follow the normal distribution. Then, apply it in a real case, that is, investment portfolio performance measurement of a pension fund managed by a private university in Malang town. Data processing was aided by MS Excel which the steps are calculating the average return (mean), standard deviation, VaR and CVaR, deviation VaR and CVaR, BI rate and STARR both in the case of a Gaussian distribution and T-Student. The result of the analysis showed that the T-Student distribution approach and STARR method are better to use for measuring pension fund investment performance than the Gaussian distribution approach and traditional Sharpe method. Two investment instruments that have the best performance are a Direct Placement and Property.

Downloads

References

2.Anjaningrum, Widiya Dewi, 2014, Analisis Kinerja dan Optimalisasi Portofolio Investasi Dana Pensiun Metode Sharpe Ratio Based On CVaR, Tesis, PPS Universitas Muhammadiyah Malang.

3.Arsanto, Bambang, 2006, Kajian Optimalisasi Portofolio Investasi pada Dana Pensiun Angkasa Pura I, Tesis, Universitas Indonesia, Jakarta.

4.Artzner, P., F. Delbaen, J. M. Eber dan D. Heath, 1997, Thinking Coherently, Journal of Risk, Vol 10, November, Pp 68-71.

5.Artzner, Philippe, Delbaen Freddy, Eber Jean-Marc dan Heath David, 1999, Coherent Measures of Risk, Mathematical Finance Journal, Vol. 9, No. 3, Pp. 203-228.

6.Best, Philip, 1999, Implementing value at Risk. John Wiley & Sons, West Sussex, England.

7.Boudt, Kris., Peter Carl dan Brian G. Peterson, 2011, Asset Allocation with Conditional Value at Risk Budgets, Journal of Risk, Volume 15, No. 3, Pp. 39-68.

8.Campbell, Rachel, Ronald Huisman dan Kees Koedijk, 2001, Optimal Portfolio Selection in a Value ar Risk Framework, Elsevier Journal of Banking & Finance 25, 1789-1804.

9.Cogneau, Philippe dan Georges Hübner, 2009, The 101 Ways to Measure Porfolio Performance, SSRN, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1326076, diakses pada tanggal 14 Juli 2016.

10.Embrechts, P., McNeil, A., dan Straumann, D., 1999, Correlation and Dependence in Risk Management. Journals Properties and Pitfalls. Augustus.

11.Gitman, Lawrence J., 2009, Principles of Managerial Finance, Twelfth Edition, Pearson Prentice Hall, New York.

12.Lin, Shan dan Mamamitsu Ohnishi, 2006, Optimal Portfolio Selection by CVaR Based Sharpe Ratio, Genetic Algorithm Approach. Scientiae Mathematicae Japanicae Online, e-2006. 1229-1251.

13.Mulyana, Deden, 2011, Evaluasi Kinerja Portofolio, https://deden08m.files.wordpress.com/2011/09/materi-14-evaluasi-kinerja-portofolio.pdf, diunduh pada tanggal 2 Juli 2016.

14.Penza, Pietro dan Bansal, Vipul, K., 2001, Measuring Market Risk with Value at Risk, John Wiley & Sons, Inc.

15.Rachev, Svetlozar, R. Douglas Martin, Borjana Racheva and Stoyan Stoyanov, 2006, Stable ETL Optimal Portfolio & Extreme Risk Management, FinAnalytic. http://www.pstat.ucsb.edu/research/papers/2006mid/White%20Paper.pdf. Accessed August 2, 2016.

16.Rockafellar, R. Tyrell dan Stanislav Uryasev, 1999, Optimization of Conditional Value at Risk, http://www.ise.ufl.edu/uryasev/files/2011/11/CVaR_JOR.pdf, Accessed June 2, 2016.

17.Satiti, Novita Ratna, 2013, Optimalisasi Portofolio Investasi Dana Pensiun Universitas Muhammadyah Malang, Tesis, UMM, Malang.

18.Shaw, William T., 2011, Risk, VaR, CVaR and Their Associated Portfolio Optimizations When Asset Returns have a Multivariate Student T Distribution. Cornell University Library, http://arxiv.org/pdf/1102.5665.pdf, Accessed June, 11, 2016.

19.Stoyanov, Stoyan V., Svetlozar T. Rachev dan Frank J. Fabozzi., 2009, Sensitivity of Portfolio VaR and CVaR to Portfolio Return Characteristics, Working Paper, Universität Karlsruhe.

20.Szegö, Giorgio, 2002, Measure of Risk. Elsevier Journal of Banking & Finance, No.26, Pp.1253-1272.

21.Tandelilin, Eduardus, 2010, Analisis Investasi dan Manajemen Portofolio, Edisi 1, Kanisius, Yogyakarta.

22.Uryasev, Stanislav, 2000, Conditional Value at risk, Optimization Algorithms and Application, Financial Engineering News, 14 February.

Yamai, Yasuhiro dan Toshinao Yoshiba, 2002, On the Validity of Value-at-Risk: Comparative Analuses with Expected Shortfall. Monetary and Economic Studies, Publication, January, Research Division I, Bank of Japan.

Downloads

Published

How to Cite

Issue

Section

License

Happy reading. Don't be shy to cite